Human Rights

Respect for human rights

Respecting human rights is essential for us. As part of compliance management, rules for equal treatment, anti-discrimination and respect for human rights are defined in the Code of Conduct and in the guidelines applied. We have taken precautions to ensure that no child or forced labor, no (modern) slavery and no human trafficking are tolerated along our value chain or in the procurement of products and services. We do not tolerate coercion, threats or exploitation of possible weaknesses or emergencies in the establishment and maintenance of work activities.

The rules of mutual respectful and ethical conduct are also enshrined in writing in our Code of Conduct (see www.grenke.com/de/unternehmen/grenke-gruppe/esg/), which is provided to all employees as part of their employment contracts, and in our Supplier Code of Conduct. These documents incorporate the relevant national and international regulations and rules that are of importance to grenke. In this way, they sensitize us to the legal risks in everyday working life and at the same time define both our claim and our promise to ethics and morals internally and externally. We strengthen and monitor the anchoring of these principles in particular through strong compliance and data protection, as well as internal audits.

Compliance and Data Protection

Risk management

We ensure our sustainable success through careful risk management. We integrate current developments and circumstances, such as the opportunities and risks of climate change, into our risk management.

Compliance management

Our Group-wide compliance management system (CMS) helps us to meet the various international requirements and prevent risks. Our aim is to use the Group-wide compliance management system (CMS) to meet the various international requirements and thus counteract operational risks and uncertainties. To ensure compliance with all national and international requirements and guidelines, we also have local compliance officers in all countries in which we are represented.

Access to financial markets

Access to financial markets

As a financial services provider, refinancing is a central component of our business. In a changing financial world, sustainability and ESG (environmental, social and governance) are becoming increasingly important - both due to the growing interest of investors and the increasing requirements of financial market regulation. ESG ratings and benchmarks play an important role here, as they facilitate access to capital for companies that are actively committed to sustainability. They also provide investors with a clear basis for evaluating the sustainability performance of companies and making informed decisions.

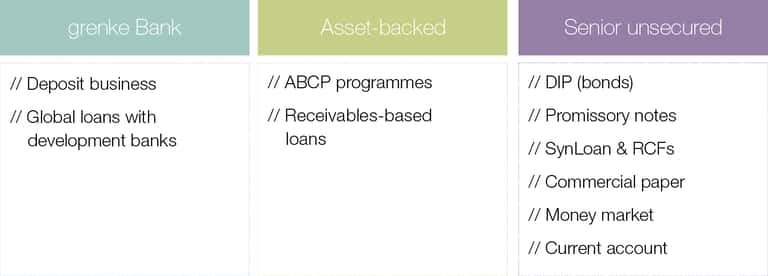

As part of our refinancing strategy, grenke Bank AG has been purchasing lease receivables from the Group companies since 2009. In addition, grenke Bank AG cooperates with various development banks by purchasing receivables from lease agreements in the form of global loans. With regard to our senior unsecured instruments, green, social or sustainability bonds, for example, enable the targeted promotion of sustainable projects.

With our Green Bond, we offer our investors the opportunity to invest in sustainability. In operational terms, we support the sustainable transformation of small and medium-sized enterprises (SMEs) by enabling them to finance green economy projects. We are guided by the Green Project Categories of the International Capital Market Association (ICMA) and finance properties in the following areas, among others: Renewable Energy, Energy Efficiency, Clean Transportation, Pollution Prevention and Control, Sustainable Water and Wastewater Management.

In 2024, we expanded our sustainable financing offering and added social product categories to our Sustainable Bond Framework in addition to green economy properties. This new framework is in line with the ICMA Green Bond Principles, the ICMA Social Bond Principles and the ICMA Sustainability Bond Guidelines.

Our Sustainable Bond Framework underlines our commitment to financing small and medium-sized enterprises, especially in countries facing social challenges in the labor market. In this way, we actively contribute to the development of a more sustainable and socially just future.

Further information can be found under the heading "sustainable refinancing" under the following button.

Corporate Governance

Here you find further information regarding our Corporate Governance.